In recent years, Greece seems to be pursuing a more active role in global energy developments. In May 2022, the country makes the historic commitment to net zero emissions by mid-century, helping to tackle climate change (National Climate Law). To do this, several energy and climate policies have been announced and implemented, helping to secure a more prominent place at the climate change table, while at the same time developing and promoting strategically competitive markets, including that of natural gas.

The binding target to end coal-fired power generation by 2028 was one of the key policies adopted, giving natural gas an increasing role in the country's energy mix. However, the Russian invasion of Ukraine and the persistent rise in natural gas prices have brought the issue of security of supply to the fore, with the Greek government reassessing the role that natural gas can play not only in the security of the domestic market, but also how it can help the country establish itself as a European hub.

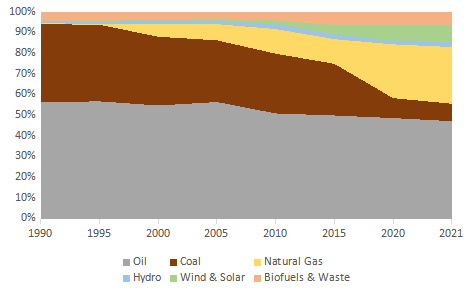

Total Energy Supply by Source in Greece

Source: IEA

However, it is important to take into account the peculiarity of the domestic natural gas market framework which lies in the lack of dedicated storage facilities at a time when the country is entirely dependent on imports from third countries.

Entry Gates of Natural Gas in Greece

Source: entsog.eu

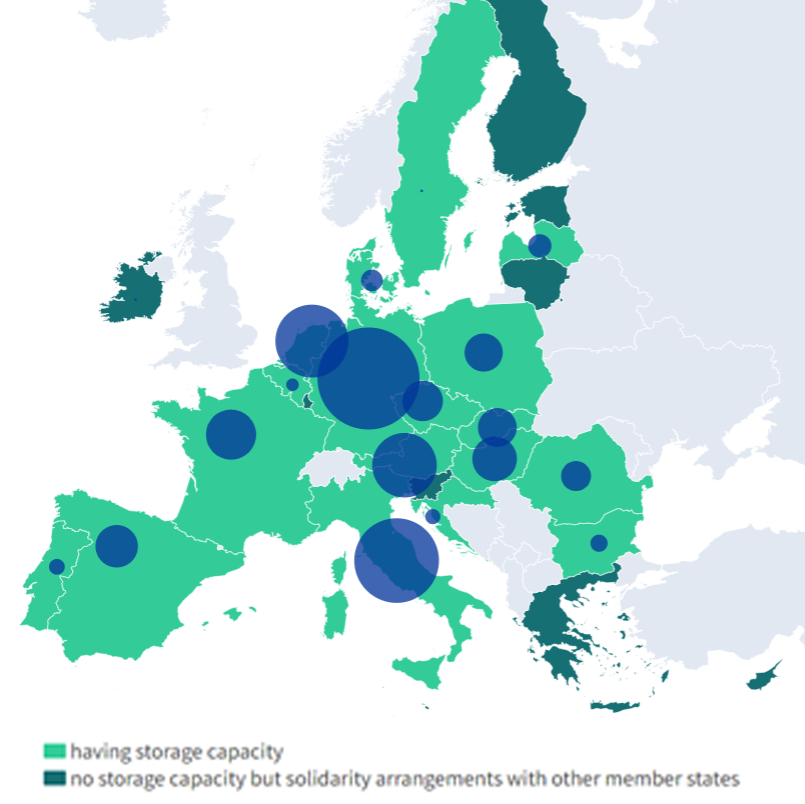

Greece is one of the few European countries that does not have dedicated natural gas storage facilities. The LNG storage in Revythoussa with a capacity of 1.54 TWh/year covers only 2.7% of the total domestic consumption (2022). While more LNG storage facilities are expected, including the Alexandroupoli FSRU, as well as the potential Dioryga Gas FSRU station, these are still expected to cover only 4% of total demand (2.6 TWh/year). However, according to the European gas storage regulation, the country needs to cover 15% of its annual consumption to secure its natural gas reserves, which implies that Greece has to look for storage sites in other member states.

Gas Storage Capacity in EU Member States

Source: European Council

The structural failure of the gas system came back to the fore last year when Europe was faced with the nightmare of gas shortages due to the war in Ukraine. While security of supply in other European countries was helped by the significant amount of natural gas storage capacity, Greece had to increase its lignite stocks as a safety reserve and tap Italy's storage areas to meet its winter gas demand.

According to DESFA, the storage of quantities of natural gas in facilities in Italy as well as the leasing of an LNG ship for a year to be used as storage costed a total of 300 million euros, when according to estimates, the cost of converting the almost exhausted natural gas field south of Kavala in underground natural gas storage is estimated at 400-450 million euros.

However, a gas crisis may happen again. At this point we list three scenarios where the Greek natural gas market, the local economy and consequently the society will find itself (again) in an emergency without the cushion of strategic reserves and exposed to the global LNG market:

- If, for any geopolitical correlation, natural gas flows from either Azerbaijan or Turkey are stopped (minimize the flow of natural gas at the entry point of New Mesembria (TAP pipeline)

- In a common cyclical phenomenon where the Asian market is in a state of gas shortage due to fundamental conditions, Greece will find itself in the uncomfortable reality of following prices as it cannot compete with this huge market. The distant Fukushima incident still evokes memories of panic in the market, just as it did with the war in Ukraine

- Winter conditions either at normal levels, or lower temperatures, something that is not unlikely in Europe, and thus in Greece, observing the historical data we have at our disposal

Natural gas is expected to be a major energy source, maintaining an important role in electricity generation as a base load source and in industrial sectors. Therefore, if Greece wants to shield its economy and mitigate the risks of a possible energy crisis, as well as play a more strategic role in the natural gas market, it should build sufficient storage capacity, as well as regulate the relevant framework for mandatory reserves between the state and the participants in the natural gas market.

At the same time, it is important to highlight the commercial value of storage facilities for domestic and regional players, where quantities of natural gas can be stored depending on the function of prices and seasonality in demand (it should be mentioned that during the previous year market signals discouraged the storage of natural gas with a negative premium due to the war in Ukraine), but also to exploit the possibility for cross-border trade to Central Europe and Italy.